OKX is a popular cryptocurrency exchange that offers a wide range of trading options for traders of all levels of experience. In this OKX Exchange Review, we will evaluate OKX’s trading options, security measures, user interface, customer support, and overall pros and cons.

1. OKX Overview – OKX Exchange Review

Whether you’re new to cryptocurrency or looking for a new exchange, you may have heard of OKX (formerly known as OKEx). It’s one of the 15 or so highest-volume cryptocurrency exchanges in the world, with a daily trading volume of around $1 billion.

1.1. What is OKX?

OKX is one of the top 20 cryptocurrency exchanges worldwide with support for a huge number of coins. It offers DeFi services to stake your currency and borrow using crypto as collateral. OKX exchange may be a good choice for many global cryptocurrency traders who are looking to buy and sell with just low exchange fees.

Only by having an account at OKX exchange can you buy crypto using a bank account, a card, or mobile wallet easily. It also offers surprisingly high yields in some cases when traders participate in saving or staking features. Although it is not the biggest cryptocurrency exchange in the world, it does a quite good job of supporting multitude currencies and a wide range of services. If you’re looking to manage your cryptocurrency activity with one login, OKX could meet your needs.

1.2. OKX overview

OKX is a centralized cryptocurrency exchange that was launched in 2017 by OKCoin, a Chinese-based exchange. The exchange is headquartered in Malta and serves users from over 100 countries worldwide. OKX offers a wide range of trading pairs and supports spot trading, margin trading, and futures trading. The exchange also offers a variety of other services, such as staking, savings accounts, and a decentralized exchange (OKX DEX).

One of the key features of OKX exchange is its advanced trading platform. The platform includes a range of tools and charting options designed to help traders make informed decisions. The platform is available as a web-based interface and mobile app, making it accessible to users on the go. OKX also has a robust security system in place, with measures such as two-factor authentication and cold storage to protect user funds.

In addition to its trading platform, OKX exchange offers a variety of other services for cryptocurrency users. Staking allows users to earn rewards by holding certain cryptocurrencies, while savings accounts offer users the ability to earn interest on their cryptocurrency holdings. OKX DEX is a decentralized exchange that allows users to trade cryptocurrencies without the need for a centralized authority.

While OKX has faced some controversies in the past, including allegations of market manipulation and concerns over its relationship with Tether (USDT), the exchange has taken steps to address these issues and has continued to grow its user base. Overall, OKX exchange is a popular choice for cryptocurrency traders looking for a reliable and feature-rich exchange.

2. Pros and Cons of OKX Exchange Review

There are some OKX Exchange Review ‘s pros and cons.

2.1. Pros – OKX Exchange Review

- Good at guiding beginners

- Well designed spot trading UI

- Successful investor follows

- No currency conversion fees or deposit fees

- Very low trading fees (max 0.10%) or less for most trades such as trading fees (from 0.10% and it may decrease with larger stakes or higher trading volumes in OKB token and OKX’s currency.

- High-interest staking opportunities: Opportunities to earn at more than a 100% annual interest rate when staking certain cryptocurrencies.

- Buy cryptocurrency easily using a card, digital wallet or bank account: Buy currencies with a few clicks with debit card or a credit, bank account transfer, Google Pay, Apple Pay, and other supported services.

- Wide Range of Trading Pairs: OKX offers a wide range of trading pairs, including spot trading, margin trading, and futures trading. Traders can also trade fiat currencies such as USD and EUR.

- Advanced Trading Platform: OKX’s advanced trading platform provides traders with a range of tools and charting options to help them make informed decisions. The platform is available as a web-based interface and mobile app, making it accessible to users on the go.

- Security Measures: OKX exchange has a robust security system in place to protect user funds. The exchange uses two-factor authentication (2FA) to secure user accounts and has implemented additional security measures, such as email notifications for account activity and IP whitelisting. OKX also uses cold storage to protect user funds.

- Other Services: OKX offers a variety of other services, such as staking, savings accounts, and a decentralized exchange (OKX DEX). Staking allows users to earn rewards by holding certain cryptocurrencies, while savings accounts offer users the ability to earn interest on their cryptocurrency holdings.

2.2. Cons – OKX Exchange Review

- Shutdown trades once due to founder arrest

- Cannot deposit fiat currency

- Unclear withdrawal fees

- Unavailable to users who are living in the United States or Canada: OKX exchange isn’t available to the U.S.-based users for compliance and regulatory reasons.

- Low liquidity for certain currencies: Though it is in the top 20 exchanges, some certain currencies trade with a low liquidity level.

- Mixed reviews from past customers: Some reviews indicate poor customer service and lost funds.

- Poor Customer Support: Some users have reported issues with OKX’s customer support. While the exchange does offer support through email and live chat, some users have reported slow response times or unhelpful support staff.

- Trading Fees: OKX’s trading fees are relatively high compared to some other exchanges. While the exchange does offer discounts for high-volume traders, this may still be a concern for some users who are looking for a more cost-effective trading platform.

3. Cryptocurrencies Available – OKX Exchange Review

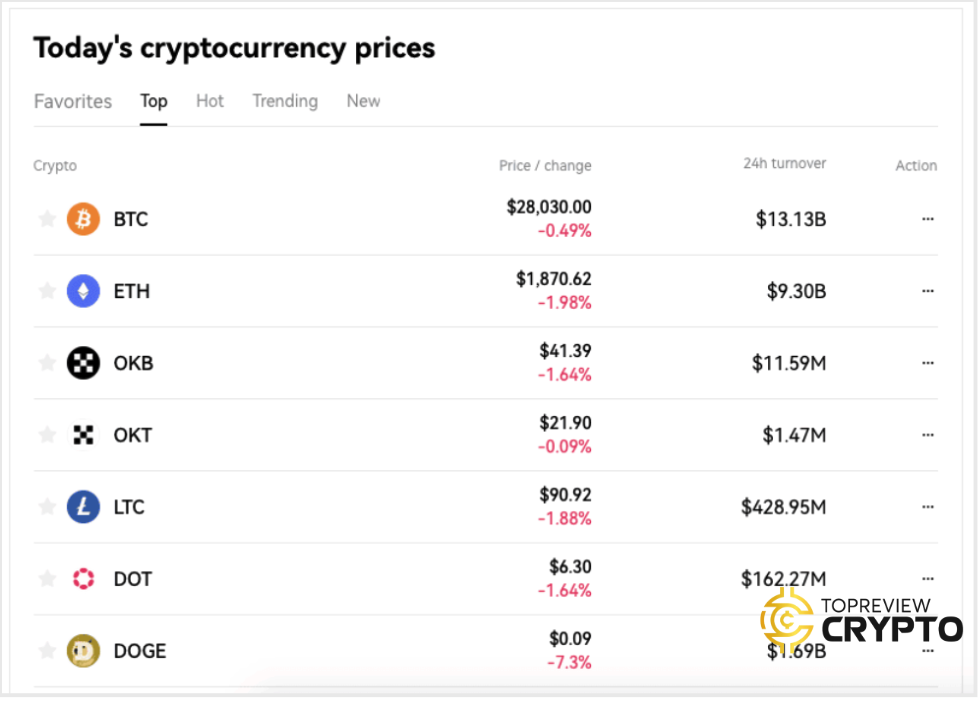

OKX offers a wide range of cryptocurrencies for trading, including both popular and lesser-known digital assets. Some of the most popular cryptocurrencies available on OKX exchange include BTC, ETH, OKB, LTC, BCH, XRP, OKT, DOT, DOGE.

In addition to these popular cryptocurrencies, OKX also supports a range of other digital assets, including:

- EOS (EOS): A decentralized platform for building decentralized applications (dapps).

- Stellar (XLM): A platform designed to facilitate cross-border payments and asset transfers.

- TRON (TRX): A decentralized platform for building dapps and digital entertainment content.

- Cardano (ADA): A platform designed for building decentralized applications and smart contracts.

- Chainlink (LINK): A decentralized oracle network that connects smart contracts to real-world data.

- Polkadot (DOT): A multi-chain platform that connects different blockchains together.

- Dogecoin (DOGE): A meme-inspired cryptocurrency that has gained popularity in recent years.

- Filecoin (FIL): A decentralized storage network that allows users to rent out their unused storage space.

- Uniswap (UNI): A decentralized exchange (DEX) that allows users to trade cryptocurrencies without the need for a centralized authority.

- Aave (AAVE): A decentralized lending platform that allows users to lend and borrow cryptocurrencies.

These are just a few examples of the many cryptocurrencies available for trading on OKX. Traders can also trade fiat currencies such as USD and EUR on the platform. OKX exchange regularly adds new cryptocurrencies to its platform, so users can expect to see new assets added to the exchange in the future.

4. Trading Experience – OKX Exchange Review

OKX offers a trading experience that is tailored to both novice and experienced traders. The exchange’s advanced trading platform provides a range of tools and charting options that can be customized to meet the needs of individual traders.

For novice traders, OKX offers a simple and intuitive trading interface that is easy to navigate. The platform includes basic order types, such as market orders and limit orders, as well as stop orders and trailing stops. The platform also provides real-time market data and price charts that can be used to monitor cryptocurrency prices and identify trading opportunities.

Experienced traders can take advantage of OKX’s advanced trading tools, including margin trading and futures trading. The platform also includes advanced charting options and technical analysis tools, such as moving averages, Bollinger bands, and RSI indicators. In addition to these tools, OKX also offers an API that allows traders to connect their own trading bots and algorithms to the exchange.

OKX’s trading fees are relatively high compared to some other exchanges, but the platform offers discounts for high-volume traders. The exchange also offers a referral program that allows users to earn commissions by referring new traders to the platform.

Overall, OKX exchange provides a robust trading experience that is suitable for both novice and experienced traders. The exchange’s advanced trading platform and range of trading tools make it a popular choice for cryptocurrency traders looking for a reliable and feature-rich trading platform.

5. Fees – OKX Exchange Review

OKX’s fee structure is relatively complex and varies depending on the type of trading and the volume of trades. Generally, the exchange charges a maker-taker fee, which means that makers (users who provide liquidity to the market by placing limit orders) are charged a lower fee than takers (users who often take liquidity from the market by placing their market orders).

5.1. Trading Fees & Rates

OKX charges trading fees based on a maker-taker fee structure, where makers (users who provide liquidity by placing limit orders) are charged lower fees than takers (users who take liquidity by placing market orders).

For spot trading, OKX exchange charges a maker fee of 0.10% and a taker fee of 0.15%. For example, if a trader placed a limit order to buy Bitcoin (BTC) at a price of $50,000, they would be charged a maker fee of 0.10% when their order is executed. Conversely, if a trader placed a market order to buy BTC at the current market price of $50,000, they would be charged a taker fee of 0.15%.

For margin trading, OKX charges a maker fee of 0.02% and a taker fee of 0.05%. Futures trading fees are based on a tiered system that is determined by the user’s trading volume over a 30-day period. If the trading volume is higher , the fees will be lower.

OKX’s trading fees are relatively high compared to some other exchanges, but the exchange offers discounts for high-volume traders. Additionally, OKX’s fee structure is transparent and easily accessible on the exchange’s website, which helps traders to understand the costs associated with trading on the platform.

It’s worth noting that fees and rates are subject to change, and traders should always check the exchange’s website for the most up-to-date information.

5.2. OKX Withdrawal Fees

OKX charges withdrawal fees that vary depending on the cryptocurrency being withdrawn. The withdrawal fees are designed to cover the network transaction fees associated with transferring the cryptocurrency from the exchange to the user’s wallet.

Here are some examples of the withdrawal fees charged by OKX:

- Bitcoin (BTC): 0.0005 BTC

- Ethereum (ETH): 0.01 ETH

- Litecoin (LTC): 0.001 LTC

- Ripple (XRP): 0.25 XRP

- Bitcoin Cash (BCH): 0.0005 BCH

- EOS (EOS): 0.1 EOS

It’s important to note that these fees may change depending on market conditions and network congestion. Traders should always check the current withdrawal fees on the OKX website before initiating a withdrawal.

Additionally, OKX may impose minimum withdrawal limits for certain cryptocurrencies. For example, the minimum withdrawal limit for BTC is 0.001 BTC, while the minimum withdrawal limit for ETH is 0.01 ETH.

6. Regular & VIP Pricing – OKX Exchange Review

OKX exchange offers a tiered fee structure that rewards high-volume traders with lower trading fees. The more a trader trades in a 30-day period, the lower their fees will be.

Regular pricing for spot trading on OKX is a maker fee of 0.10% and a taker fee of 0.15%. However, traders can qualify for VIP pricing based on their trading volume over a 30-day period.

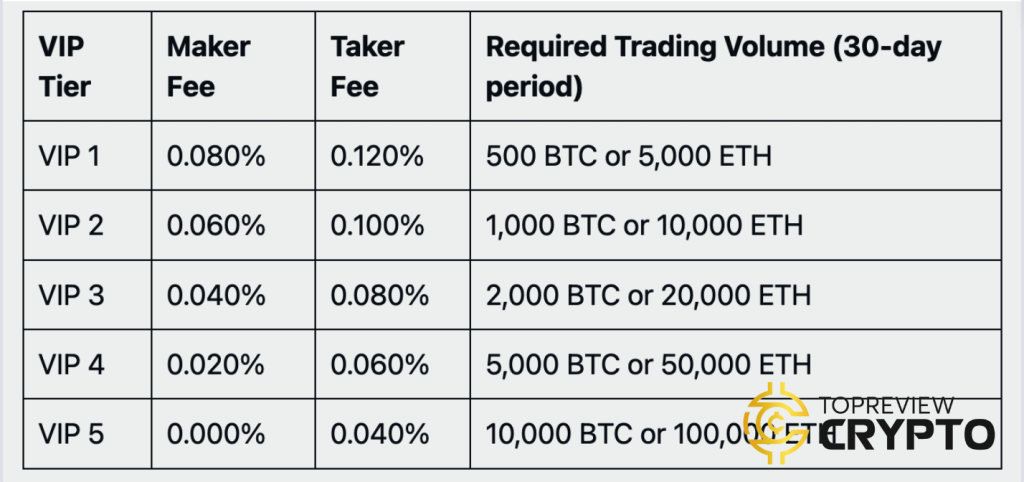

Here are the VIP trading fees for spot trading on OKX:

OKX exchange considers you a regular user until you hold at least $100,000 in assets OR trade $10,000,000 within 30 days — then you become a VIP.

- VIP 1: Maker fee of 0.080%, taker fee of 0.120%. Requires a trading volume of at least 500 BTC or 5,000 ETH in the previous 30 days.

- VIP 2: Maker fee of 0.060%, taker fee of 0.100%. Requires a trading volume of at least 1,000 BTC or 10,000 ETH in the previous 30 days.

- VIP 3: Maker fee of 0.040%, taker fee of 0.080%. Requires a trading volume of at least 2,000 BTC or 20,000 ETH in the previous 30 days.

- VIP 4: Maker fee of 0.020%, taker fee of 0.060%. Requires a trading volume of at least 5,000 BTC or 50,000 ETH in the previous 30 days.

- VIP 5: Maker fee of 0.000%, taker fee of 0.040%. Requires a trading volume of at least 10,000 BTC or 100,000 ETH in the previous 30 days.

It’s worth noting that these fees are for spot trading only, and fees for margin trading and futures trading may be different. Additionally, traders must maintain the required trading volume to qualify for VIP pricing, and fees may revert to regular pricing if the trading volume falls below the VIP threshold.

7. Crypto Trading – OKX Exchange Review

OKX is a popular cryptocurrency exchange that offers a wide range of cryptocurrencies for trading. Traders can buy and sell digital assets on the exchange’s spot, margin, and futures markets.

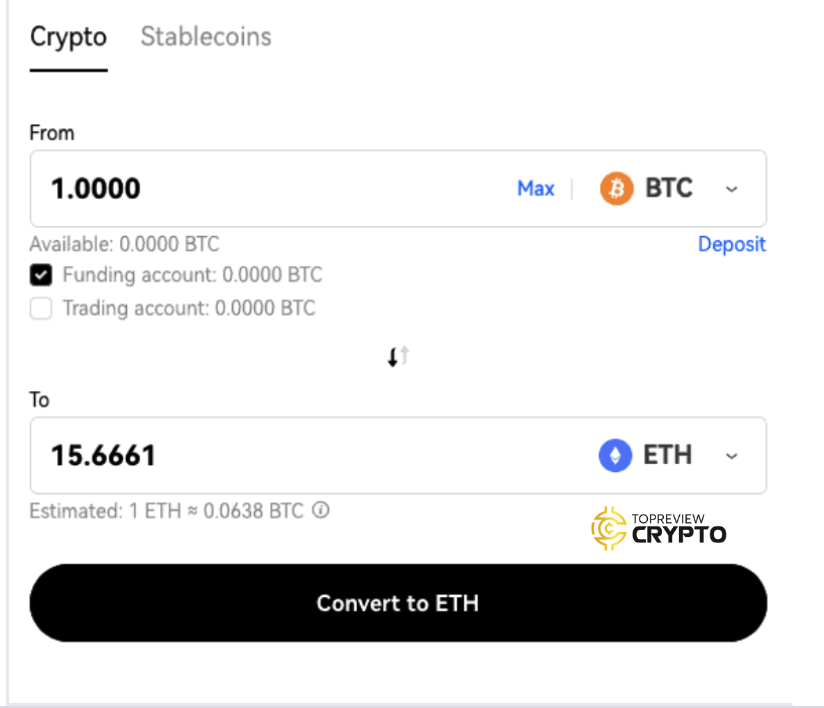

OKX converts between cryptocurrencies instantly.

Here’s a breakdown of the different types of trading available on OKX:

- Spot Trading: This is the most common type of trading on OKX. Traders can buy and sell cryptocurrencies in real-time at the current market price. OKX exchange charges a maker-taker fee, which means that makers (users who provide liquidity to the market by placing limit orders) are charged lower fees than takers (users who often take liquidity from the market by placing their market orders).

- Margin Trading: OKX also offers margin trading, which allows traders to borrow funds from the exchange to increase their buying power. This type of trading can be risky, as losses can exceed the initial investment. OKX charges a margin fee and a funding fee for margin trading.

- Futures Trading: OKX offers futures trading, which allows traders to speculate on the future price of a cryptocurrency. Futures contracts are settled in the future, at a predetermined date and price. OKX charges a maker-taker fee for futures trading, and fees are based on a tiered system that is determined by the user’s trading volume over a 30-day period.

8. Security Measures – OKX Exchange Review

OKX takes security very seriously and has implemented several measures to protect users’ funds and personal information. Here are some of the security measures that OKX uses:

- Two-Factor Authentication (2FA): OKX requires users to enable 2FA when logging in or making withdrawals. This adds an extra layer of security by requiring users to enter a code generated by an authentication app on their mobile device.

- Cold Storage: OKX stores the majority of users’ funds in cold storage, which means that the funds are stored offline in an isolated environment that is not connected to the internet. This helps to protect the funds from hacking and other online attacks.

- Secure Socket Layer (SSL) encryption: OKX uses SSL encryption to protect users’ personal information and data. SSL is a standard security protocol that encrypts data between a user’s browser and the exchange’s servers, making it difficult for hackers to intercept and steal the data.

- Anti-Phishing Measures: OKX provides users with tips on how to avoid phishing scams and regularly reminds users to be vigilant when receiving emails or messages that ask for personal information or login credentials.

- KYC and AML Procedures: OKX requires users to complete Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures before they can trade on the platform. This helps to prevent fraud and money laundering by ensuring that users are who they claim to be and that their funds are obtained through legitimate means.

- 24/7 Monitoring: OKX’s security team monitors the exchange’s systems and network 24/7 to detect and prevent any unauthorized access or suspicious activity.

OKX’s security measures are robust and designed to protect users’ funds and personal information. However, users should also take their own precautions, such as using strong passwords and not sharing login credentials with anyone.

9. Opening an OKX Account – OKX Exchange Review

Opening an account on OKX is a straightforward process and can be completed in a few simple steps. Here’s an overview of how to open an OKX account:

- Go to the OKX website: Visit the OKX website (www.okx.com) and click on the “Sign Up” button at the top right corner of the page.

- Enter your details: Enter your email address and create a strong password. Agree to the terms of service and click on the “Sign Up” button.

- Verify your email: OKX will send you a verification email. Click on the link in the email to verify your email address.

- Complete KYC and AML procedures: To trade on OKX exchange, you must complete the Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. This involves providing personal information, such as your name, address, and identification documents.

- Enable two-factor authentication (2FA): OKX requires users to enable 2FA for added security. Download and install a 2FA app, such as Google Authenticator, and link it to your OKX account.

- Fund your account: After verifying your account, you can fund it with fiat currency or cryptocurrency. OKX supports a wide range of cryptocurrencies and fiat currencies, such as USD and EUR.

After completing these steps, you can start trading on OKX. The exchange provides a user-friendly trading platform with advanced trading tools and features, suitable for both novice and experienced traders.

Unverified accounts can only withdraw up to 10 BTC/ day and trade up to $500/ day, while other higher levels give you both higher transaction limits and withdrawal limits.

In conclusion, OKX is a well-established and reputable cryptocurrency exchange that offers a wide range of trading options for traders of all levels of experience. After reading this OKX Exchange Review, if you have any questions, please contact us via Hotline: 0329.695.510.

- Phemex Referral Code: ELRCB5 Get Up to $8,800 Welcome Rewards! 💸🚀

- Use Binance Referral Code 136043826 to Save Up to 20% on Transaction Fees!

- Okx referral code is 92494249 Claim up to 60,000 USDT in exclusive rewards

- Crypto Exchange Referral Codes: Latest Big Deals and Offers Update

- Bybit crypto exchange review – everything about Bybit exchange